Accept Credit Cards on your website now. We help your business setup credit card processing for Canadian businesses. Accept payments by credit card online now. We simplify the process.

Accept Credit Card Payments Online

PURCHASE

AUTHORIZE

DEPOSIT

Credit Card Processing Canada

Process credit card payments on your website!

We can help you with credit card processing in Canada. There are a few different methods to accepting credit cards online, on the right side please see the options available.

Process Credit Cards Online

Allow customers to make payments through your ecommerce software online. Increase sales conversions that can accept payments real-time. All payments are secure and immediate.

Integrate Bambora payment processing with your current Woocommerce or Zencart website. Contact us to see our sample Woocommerce site.

What is a virtual terminal?

A Virtual Terminal allows your customers to capture phone and mail-in payments from anywhere with an internet connection. All nonprofits need to do is collect the credit card information from the donor, and type it into the terminal.

You also will have access to the Virtual Terminal to charge your customers when they give you their card information. It’s exactly like the terminal you would use at a supermarket. But it’s online and that you need to key in the card details.

The world of online payments is continuously changing. When you offer the payment types that matter to your customers, you ensure they will never miss out on a payment. From credit cards to digital wallets, you’ll have peace of mind knowing all your options are covered.

Credit Cards: Visa, MasterCard, American Express, Discover, JCB.

Debit Cards: Interac Online, Visa Debit, MasterCard Debit.

Wallets: Apple Pay, Visa Secure Remote Commerce, MasterCard MasterPass.

Direct Payments: EFT, ACH.

Re-use payment details

Store your customer’s payment information to re-use for one-off or recurring transactions. The profile will be stored on our PCI Level 1 server (bypassing your software), allowing you to reduce your PCI scope. Recurring billing allows you to automate payments that occur at set intervals. Businesses can avoid data entry mistakes while decreasing both cost and time spent processing their billing files. Businesses can also proactively help to reduce credit card declines and out-of-date card information by scheduling email alert notifications for soon to be expired credit cards or through the help of card updater.

Business who have a recurring billing cycle, i.e., gyms, SaaS software companies, municipalities or charities can improve their accounts receivable by implementing an automated recurring billing solution.

PAYMENT GATEWAY

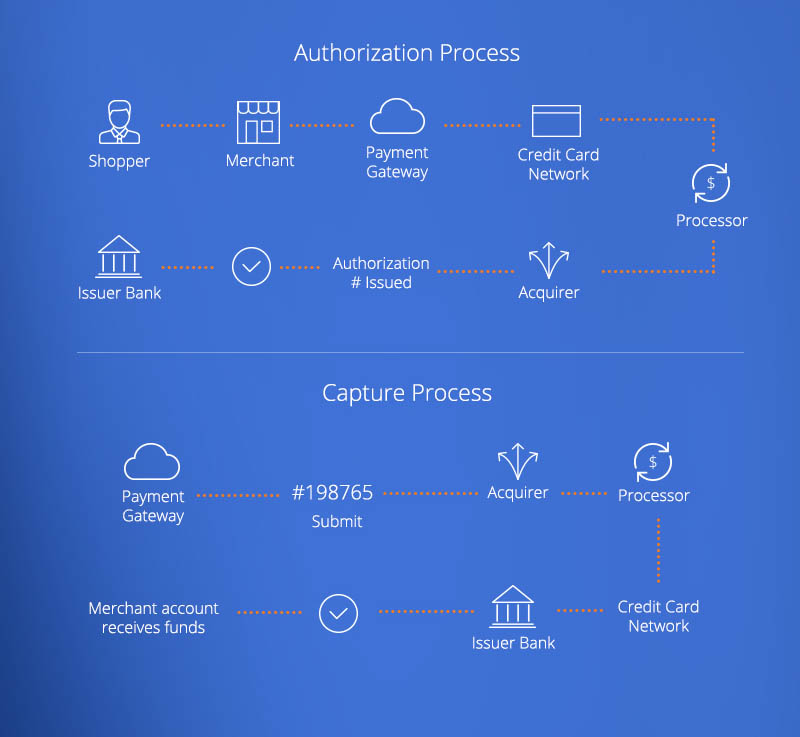

Merchant Account and Payment Gateway: Why You Need Both. A merchant account is an account where your payments are processed. A payment gateway makes the connection between the merchant account and your bank account. Without this, money will not flow to your business bank account. We handle both for you in one simple fee.

There are many reasons why this is separated into two parts, but the main reason is choice. There are many payment processors offering different fees and terms. We deal with a payment gateway processor, Bambora.

MERCHANT ACCOUNT PLANS

* Fees vary with volume and charge amounts for merchant accounts and payment gateways. Please contact us for a proper quote. Send us a competitor invoice and we can try to beat it.

Already Processing?

If you have an existing payment gateway and merchant account, we can make it worth your time to switch over. We will guarantee meeting or beating the current rates, include a dedicated account manager add many more features to your platform.

EXTRA PAYMENT SERVICES

BATCH PROCESSING

RECURRING BILLING

CURRENCY SOLUTIONS

TOKENIZATION

VIRTUAL TERMINAL

PAYMENT FORMS

These features can be added to any account. Please contact us for more information.

MERCHANT ACCOUNT FAQ

What plan is right for me?

The pay as you go plan was designed to help businesses easily get up and running with payments. The tools are great for businesses just getting started, or existing businesses looking to launch into the e-commerce space. The Advance is meant for businesses who process higher volumes. You can also seamlessly transition from Pay As Yo Go to Advance. If you have more questions about which package is right for, contact our sales team. They will be able to help you.

How much do I have to process to qualify for custom pricing?

The threshold is determined and regulated by card associations (Visa $100,000, MasterCard $1,000,000 and Amex $500,000) and merchants only have to meet one threshold to advance to an Advance account.

How long does it take to get paid?

Typically merchants will receive their payment 3 business days after the purchase.

What are your chargeback fees?

There is a $20.00 fee for chargebacks. If a merchant disputes the chargeback and can provide proof of purchase, the fee is returned.

Do you offer charity pricing?

Yes, please contact us and we can provide the appropriate rate.

What card types are included in the 2.75% + $0.15 per transaction?

Visa, MasterCard, and Amex.

MasterPass and Visa Debit are included but have to be enabled by our Customer Service team.